Options might seem a bit more complicated than stocks but there are only a few basic types of options-one for buying stocks, one for selling, and one for making cash bets on stock prices. All in all, this slightly more complicated way of trading can yield greater results if done correctly. Nonetheless, day traders like these financial instruments so much because they can hedge risk with options, as well as open and close positions more quickly. This kind of trading is a bit more complicated than buying and selling stocks, which is relatively straightforward. So, if you can predict the price movement, you win-but if you make a mistake, you can still sell your contract and get out of your position before taking a big loss. In this sense, options differ from stocks significantly: instead of buying shares directly, you can buy a contract that allows you to purchase or sell the security in question at a later date, and at today’s price. Therefore, traders can use these contracts to essentially bet on assets they think are going to lose or gain value. Not all stocks can be traded the same way, so let’s see how options work and what are the most effective ways to trade them.Īn options contract allows you to buy or sell an asset for an agreed-upon price within a certain timeframe. In this guide, we will explain some of the popular strategies for day traders that you can implement today and improve your gains while minimizing risk. After this is taken care of, it all comes down to practice and discipline-but if you can start making money right off the bat, all the better.

TRADING OPTIONS HOW TO

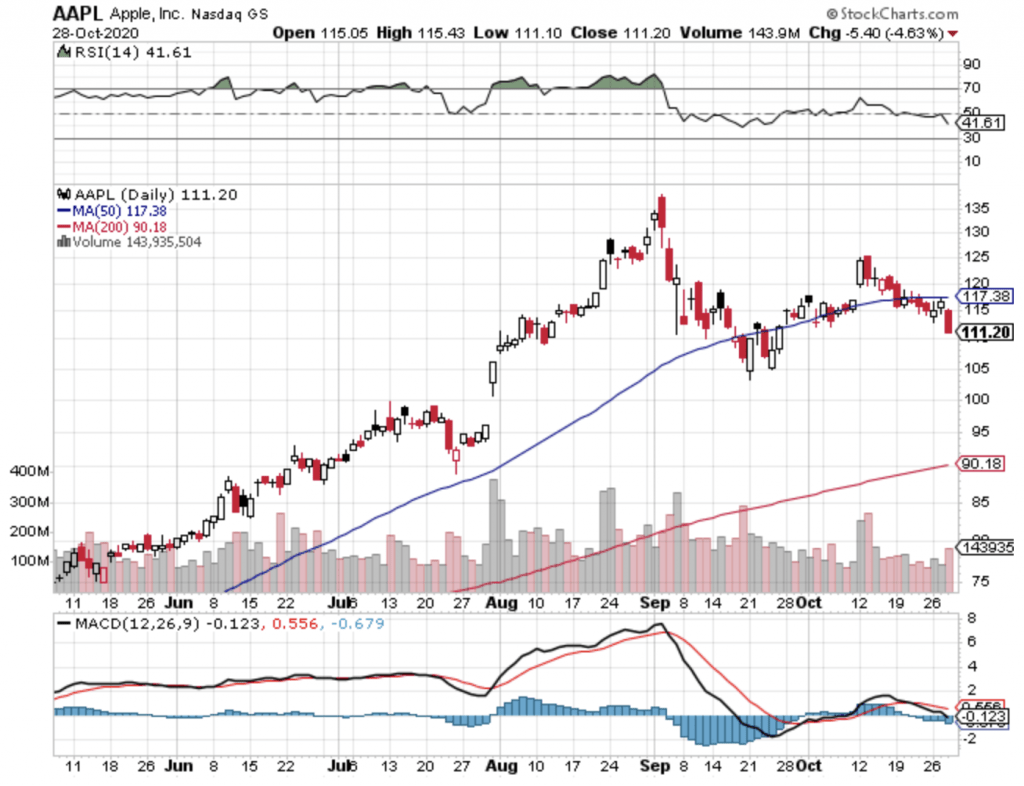

However, not all rookies will have a good time-day trading options isn’t something you should get into without a plan.ĭon’t make the rookie mistake of diving in unprepared! ⚠️īefore you can reliably make a buck through options, you should know how to do your research, find the right broker, and have a strategy that works. The reasons why the number of options traders soared recently are many-but most newcomers are entering the game to make up the losses they experienced during the lockdown by trading in today’s opportunity-rich market. Compared to the same month the previous year, this is a 48% increase, which goes to tell us that many people have cause to trade. This goes especially for options traders-in October 2020 alone there were almost $600 million calls and puts traded in the US.

TRADING OPTIONS FULL

This created a trading environment that is as volatile as it is full of opportunity, and many investors have jumped on the day trading bandwagon. The effect of the pandemic is still felt-by and large, stocks have seen huge drops and unprecedented jumps in the recent past. With COVID-19, the entirety of 2020 has been a rollercoaster for our little planet-including the stock market. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Neither our writers nor our editors receive direct compensation of any kind to publish information on. Day Trading Options (2022): The Only Guide You Need NewsletterĪll reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team.

0 kommentar(er)

0 kommentar(er)